Spotify Technology Unusual Options Activity For May 19

Spotify Technology (NYSE: SPOT), the world’s biggest music streaming service with millions of songs, playlists, and podcasts, huge revenue, and market shares, faces fierce competition from its rivals like Apple Music, Amazon Music, and YouTube Music. One way to gauge how investors feel about Spotify’s prospects is to look at the options market, where traders can buy or sell contracts that give them the right to buy or sell shares of a stock at a certain price by a certain date. Options are often used to hedge against risk, speculate on future price movements, or generate income from existing positions.

On May 19, 2021, Spotify saw some unusual options activity that indicated a bullish sentiment among traders. According to Spotifybuzz research, 13,879 calls and 3,571 puts were traded that day, with a call/put ratio 3.89. The most active contract was the $300 call expiring on June 18, 2021, with 4,621 contracts traded and implied volatility of 43.63%. This means that traders were betting that Spotify’s share price would rise above $300 by mid-June, about 17% higher than the closing price of $256.59 on May 19.

How to Interpret Spotify’s Options Activity

We need to look at some key metrics and terms to understand what Spotify’s options activity means.

A call option gives the buyer the right to buy a stock at a certain price (the strike price) by a certain date (the expiration date).

A put option gives the buyer the right to sell a stock at a certain price by a certain date.

The call/put ratio is the number of calls traded divided by the number of puts traded. A high call/put ratio indicates traders are more optimistic than pessimistic about the stock’s future performance.

The most active contract is the one with the highest volume of trades.

Implied volatility measures how much the market expects the stock price to fluctuate in the future. High implied volatility means traders anticipate more risk and uncertainty for the stock.

Why Traders Are Bullish on Spotify

There could be several reasons why traders are bullish on Spotify.

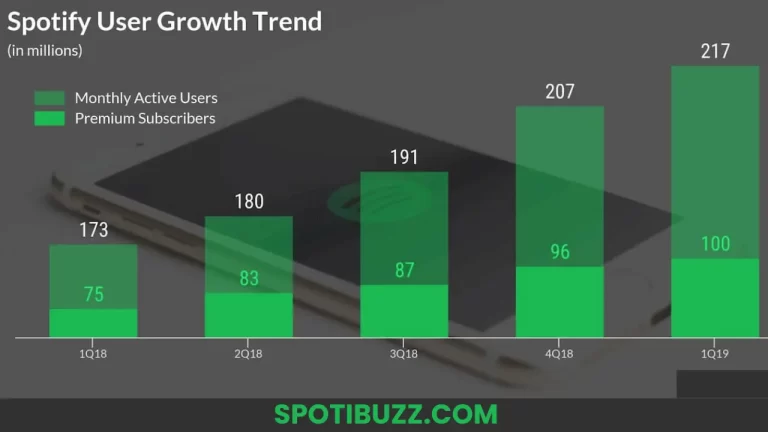

One possible reason is that Spotify has been showing strong growth in its revenue, subscribers, and market share. In the first quarter of 2023, Spotify reported a 14% year-over-year increase in revenue, a 15% increase in monthly active users, and a 14% increase in premium subscribers. Spotify also claimed to have the largest global music streaming market share, with 35% of the total listening hours.

Another possible reason is that Spotify has expanded its content offerings and partnerships, especially in the podcast segment. Spotify has acquired several podcast companies and studios, such as Anchor, Gimlet, Parcast, and The Ringer. Spotify has also signed exclusive deals with popular podcasters and celebrities, such as Joe Rogan, Barack Obama, Michelle Obama, Kim Kardashian West, and Prince Harry and Meghan Markle. These moves could help Spotify attract more listeners and advertisers to its platform.

A third possible reason is that Spotify has been innovating its technology and features, such as launching new markets, introducing new subscription plans, developing new formats and tools for creators and listeners, and experimenting with new monetization models. These initiatives could help Spotify enhance its user experience and retention, diversify its revenue streams, and increase its competitive edge.

How Spotify Stacks Up Against Its Rivals

According to a report by Business of Apps, Spotify had a 35% share of the global music streaming market in 2020, followed by Apple Music with 19%, Amazon Music with 15%, and YouTube Music with 8%. However, these Spotify’s rivals have some advantages over Spotify, such as having larger ecosystems, deeper pockets, more diversified offerings, and more loyal customers. For example, Apple Music benefits from its integration with

Apple’s devices and services include the iPhone, iPad, Mac, Apple Watch, AirPods, Siri, iTunes, and Apple TV.

Amazon Music leverages its Prime membership program, offering free music streaming and other perks like free shipping, video streaming, and cloud storage.

YouTube Music capitalizes on its massive user base and video content library.

Pandora and Deezer have more personalized and curated music recommendations based on user preferences and behavior.

Therefore, Spotify must constantly innovate and differentiate itself from its competitors to maintain its leadership position and grow its market share. According to a report by IFPI, the global music streaming market grew by 9% to $26.2 billion in 2023. Total streaming revenues rose 11.5% in 2023, bringing the segment’s share of the overall music market to 67%. Spotify remained the dominant music streaming service with 180 million subscribers, followed by Apple Music with 90 million, Amazon Music with 70 million, and YouTube Music with 50 million. However, these numbers may change as new entrants and challengers emerge in the fast-growing and dynamic music-streaming industry.

What The Experts Say On Spotify Technology

The experts have different opinions and ratings on Spotify Technology based on their analysis of the company’s performance, prospects, and valuation. Here are some of the latest analyst ratings and price targets for Spotify Technology as of May 2023:

Rosenblatt Securities: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Boosted target from $110 to $141.

VNET Group: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Maintained rating.

Bank of America: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Boosted target from $143 to $165.

Guggenheim: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Boosted target from $155 to $165.

Loop Capital: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Boosted target from $110 to $130.

Deutsche Bank: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Boosted target from $115 to $130.

The Goldman Sachs Group: Subscribe to MarketBeat All Access for the recommendation accuracy rating. Maintained rating and target at $180.

The average twelve-month price target for Spotify Technology is $143.13, with a high price target of $180 and a low price target of $95. The consensus rating for Spotify Technology is Moderate Buy, based on 7 hold ratings and 15 buy ratings. However, these ratings and targets may change as new information and developments emerge in the audio-streaming industry.

[su_heading size=”14″]

Final Analysis

[/su_heading]

On May 19, Spotify saw some unusual options activity that indicated a bullish sentiment among traders. They were betting that Spotify’s share price would rise above $300 by mid-June, about 17% higher than the closing price on May 19. The experts have different opinions and ratings on Spotify Technology based on their analysis of the company’s performance, prospects, and valuation. The average twelve-month price target for Spotify Technology is $143.13, with a high price target of $180 and a low price target of $95. The consensus rating for Spotify Technology is Moderate Buy, based on 7 hold ratings and 15 buy ratings. However, these ratings and targets may change as new information and developments emerge in the audio-streaming industry. Investors interested in Spotify Technology should be aware of the risks and rewards of options trading and the factors that could affect the company’s share price in the future.